From St Louis Association of Realtors:

Rising inflation, soaring home prices, and increased mortgage interest rates have combined to cause a slowdown in the U.S. housing market. To help quell inflation, which reached 8.6% as of last measure in May, the Federal Reserve raised interest rates by three quarters of a percentage point in June, the largest interest rate hike since 1994. Higher prices, coupled with 30-year fixed mortgage rates approaching six percent, have exacerbated affordability challenges and rapidly cooled demand, with home sales and mortgage applications falling sharply from a year ago.

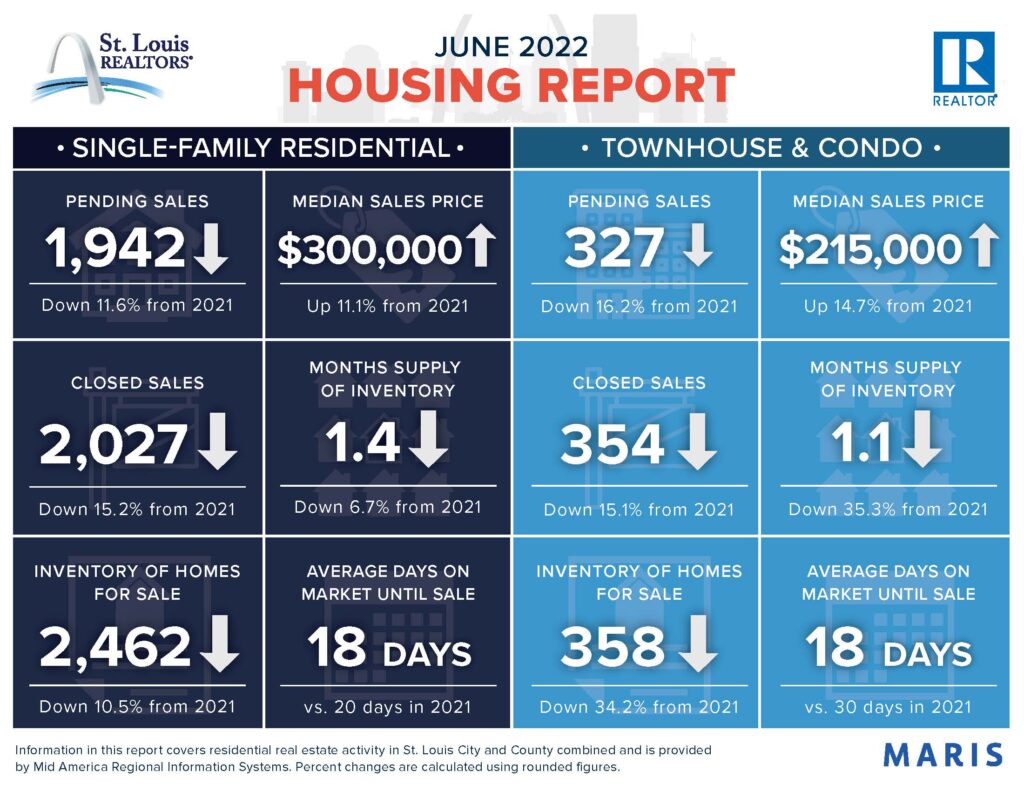

New listings decreased 7.9% for residential homes and 20% for townhouse/condo homes. Pending sales decreased 11.6% for residential homes and 16.2% for townhouse/condo homes. Inventory decreased 10.5% for residential homes and 34.2% for townhouse/condo homes.

Median sales price increased 11.1% to $300,000 for residential homes and 14.7% to $215,000 for townhouse/condo homes. Days on market decreased 10% for residential homes and 40% for townhouse/condo homes. Months supply of inventory decreased 6.7% for residential homes and 35.3% for townhouse/condo homes.

With monthly mortgage payments up more than 50% compared to this time last year, the rising costs of homeownership have sidelined many prospective buyers. Nationally, the median sales price of existing homes recently exceeded $400,000 for the first time ever, a 15% increase from the same period a year ago, according to the National Association of REALTORS®. As existing home sales continue to soften nationwide, housing supply is slowly improving, with inventory up for the second straight month. In time, price growth is expected to moderate as supply grows; for now, however, inventory remains low, and buyers are feeling the squeeze of higher prices all around.

Leave a Reply