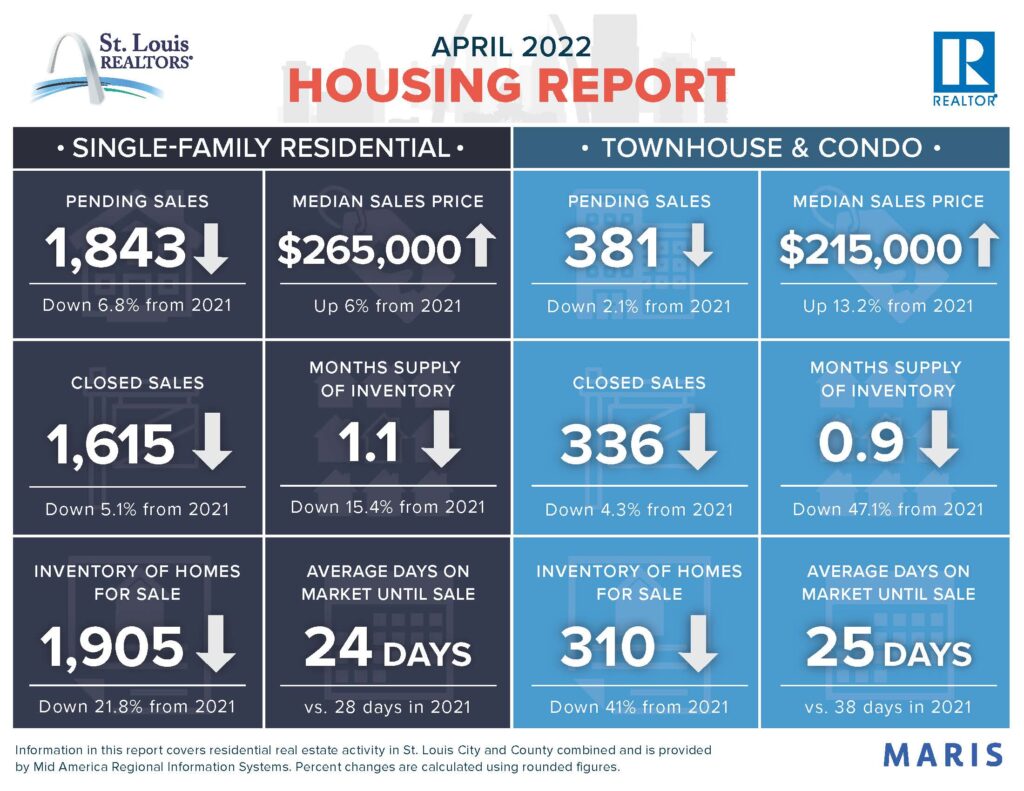

From St Louis Association of Realtors: The average 30-year fixed rate mortgage exceeded 5% in April, the highest level since 2011, according to Freddie Mac. The recent surge in mortgage rates has reduced the pool of eligible buyers and has caused mortgage applications to decline, with a significant impact on refinance applications, which are down more than 70% compared to this time last year. As the rising costs of homeownership force many Americans to adjust their budgets, an increasing number of buyers are hoping to help offset the costs by moving from bigger, more expensive cities to smaller areas that offer a more affordable cost of living. New Listings decreased 11.0 percent for Residential homes and 8.6 percent for Townhouse/Condo homes. Pending Sales decreased 6.8 percent for Residential homes and 2.1 percent for Townhouse/Condo homes. Inventory decreased 21.8 percent for Residential homes and 41.0 percent for Townhouse/Condo homes. Median Sales Price increased 6.0 percent to $265,000 for Residential homes and 13.2 percent to $215,000 for Townhouse/Condo homes. Days on Market decreased 14.3 percent for Residential homes and 34.2 percent for Townhouse/Condo homes. Months Supply of Inventory decreased 15.4 percent for Residential homes and 47.1 percent for Townhouse/Condo homes. Affordability challenges are limiting buying activity, and early signs suggest competition for homes may be cooling somewhat. Nationally, existing home sales are down 2.7% as of last measure, while pending sales dropped 1.2%, marking 5 straight months of under contract declines, according to the National Association of REALTORS®. Inventory remains low, with only 2 months supply at present, and home prices continue to rise, with the median existing home at $373,500, a 15% increase from this time last year. Homes are still selling quickly, however, and multiple offers are common in many markets.

Leave a Reply